Technology stocks have had a great run over the last decade. Among them, the group of so-called FAANG stocks – Facebook, Apple, Amazon, Netflix and Google – has been a massive outperformer. As the valuations of these tech giants have skyrocketed, owning FAANG has been one of the most popular (and profitable) trades among hedge funds. However, since these tech giants have become so dominant, they are facing mounting headwinds like regulatory scrutiny, privacy scandals, market saturation, and increased competition. This all came to the forefront in 2018.

When U.S. trade negotiations with China deteriorated and dragged the equity market lower in the fourth quarter of 2018, some investors took profit in the highest-flying, high-valued tech stocks. FAANG valuations suffered as a result. In 2019, investor capital has now been rotating into a “new FAANG” with massive growth potential: the software-as-a-service, or SaaS, subsector of TMT.

The opportunity for growth in the SaaS space is attributable to a few trends.

First, many believe that we are in the early innings of a multi-decade shift to cloud computing as more and more companies transition some or all of their business functions to the cloud. Software companies that are on the cloud or assist companies to move to the cloud benefit from this shift.

Secondly, a trend across software companies has been a change in the business model from traditionally larger, up-front payments to subscription-based models with smaller monthly payments. Investors have embraced this change and have driven up the companies’ valuations, since the subscription-based revenue streams are more predictable and have limited cyclicality. Just as important, these SaaS companies are, on average, smaller than their FAANG counterparts and have less exposure to Chinese markets and, in turn, to political and macro risks.

Lastly, the space is ripe for M&A activity, driven by both vertical and horizontal acquisitions. According to Software Equity Group’s quarterly update , M&A transactions within the SaaS space are at an all-time high, with over 250 transactions in each of the past four quarters through 2Q 2019.

PivotalPath created its own custom index of popular SaaS stocks held by hedge funds, the PivotalPath SaaS Basket. As shown below, this collection of stocks has outperformed the FAANG stocks year-to-date through August 2019 and significantly outperformed in 2018 as well as on a 1-year, 3-year, and 5-year basis.

With the outperformance of SaaS stocks, we would expect that TMT hedge funds with strong recent performance likely held a portion of their portfolio in some of these names. Looking at hedge fund performance across our 40 customized benchmarks, the TMT Hedge Fund Index is the best performing year-to-date. The peer group is up 14.5%, on average, through July 2019.

We then broke it down further into quartiles based on YTD performance through July 2019. The table below shows that top quartile funds had a net long beta to both SaaS and FAANG and had a bias to small-cap, growth companies while bottom quartile funds had relatively neutral exposure to all of the risk factors.

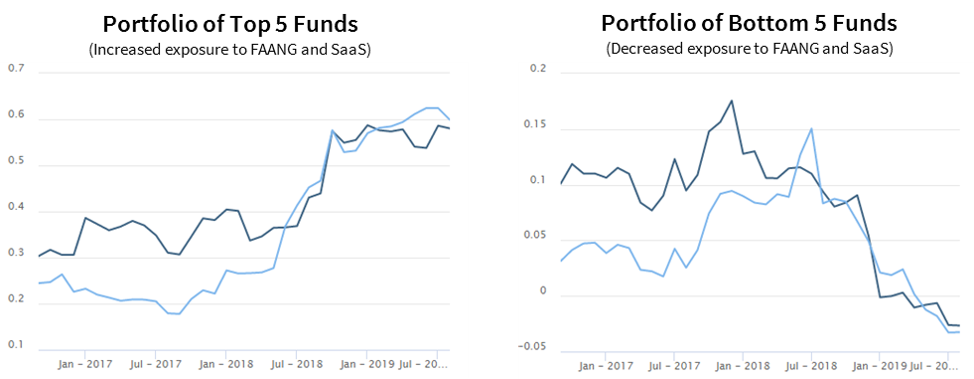

To further examine the difference in performance, we constructed separate (equally-weighted) portfolios of two groups: the “Top 5” performing TMT funds YTD and the “Bottom 5” performing TMT funds YTD. Then, we looked at the portfolios’ 18-month rolling betas to both FAANG and SaaS.

As you can see from the charts below, the Top 5 funds appear to have increased their beta to FAANG (dark blue line) and SaaS (light blue line) over time while, on the contrary, the Bottom 5 funds have had minimal exposure. Moreover, for the Top 5 funds, beta to SaaS has recently surpassed beta to FAANG, as beta to FAANG seems to have stalled over the past 12 months. This difference in positioning helps explain performance between the two groups.

The shift to the “new FAANG” is unlikely to stop anytime soon, as long as performance is there. Investors should consider their exposure to SaaS versus FAANG going forward, and whether cloud-based software names continue to drive returns.