Highlights:

Two areas we plan to cover in-depth in our upcoming year-end review are hedge fund dispersion and the pace of new launches. Below, we provide preliminary snapshots of both. We look forward to sharing this analysis, along with insights about other compelling industry trends, with you in early 2021.

-

Equity Sector tops the charts for performance and alpha this year, the same strategy that dominated 2019. It’s no surprise Equity Sector funds comprise the most fund launches through November of this year (45% of 2020’s launches thus far, 32% of last year’s through the same month).

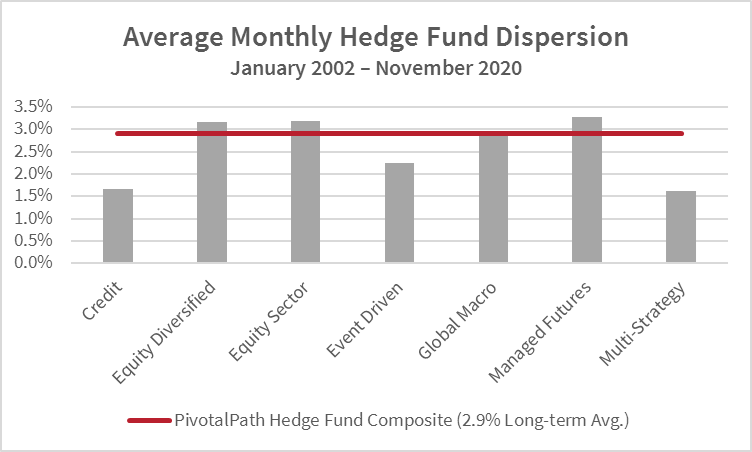

Any statistically significant lookback used to measure the year’s hedge fund volatility will be skewed by the turbulence COVID-19 unleashed on the markets in February-March. Dispersion, a cross-sectional analysis of the distribution over a certain time period, offers a much more accurate indicator. Below, we break out the long-term average dispersion levels by strategy.

-

After months of below-average dispersion from May-October 2020, November saw our indicator double on a month-over-month basis, reaching 5.8% compared to October’s 2.9%. Increased dispersion in the markets favors hedge funds, creating buying opportunities on both the long and short sides. Increased dispersion in manager performance also creates opportunities for allocators, especially those with thoughtful, systematic and peer group-driven research processes. We will be keeping an eye on this indicator as we close the books on 2020 and embark on 2021.