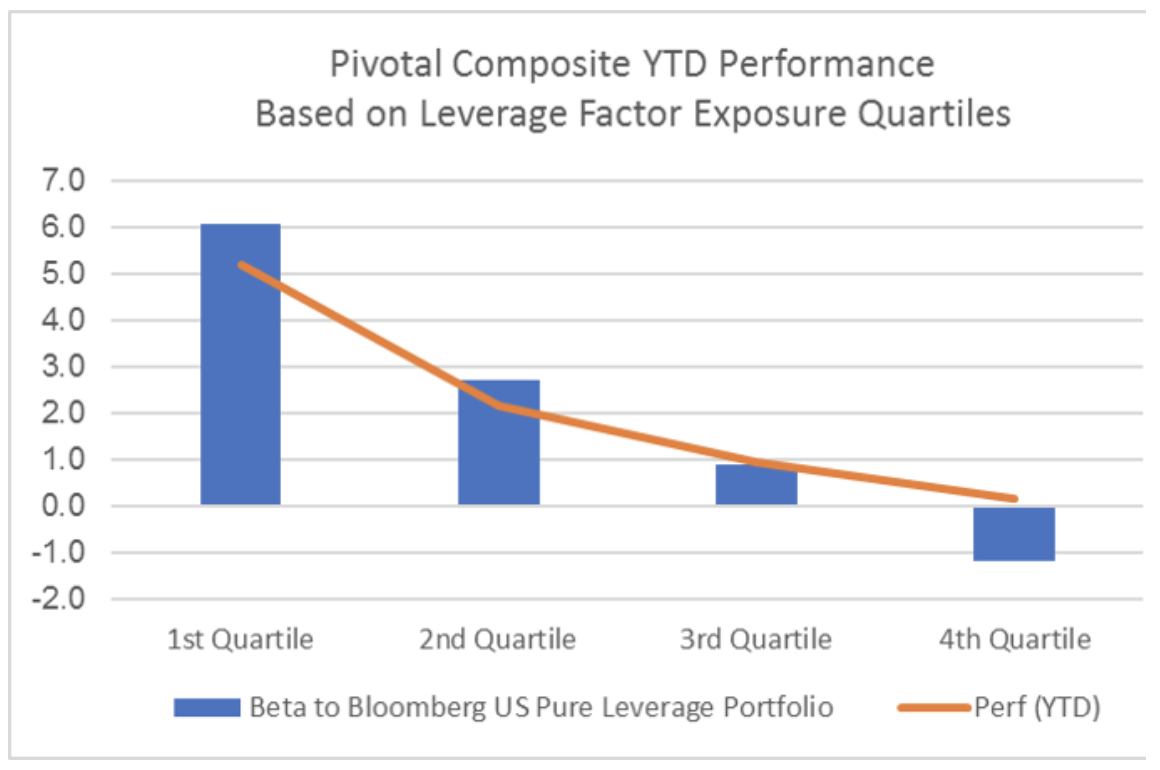

What if we told you that one risk factor can explain most of the significant dispersion in returns in the first quarter of 2019? That factor is the Bloomberg US Pure Leverage Portfolio (“Leverage”), a measurement that tracks U.S. companies that are highly indebted, or leveraged. Put another way, it is a measure of quality. The quartiles below are based on fund exposure to the Leverage factor in the Pivotal Composite Index, which represents over a thousand institutional-quality hedge funds.

Fund performance is represented by the orange line corresponding to the percentages on the right, while beta to Leverage is represented by the blue bars corresponding to the numbers on the left. We can clearly see that 6.8% separates performance of first quartile funds from fourth quartile funds, based on beta to the Leverage factor.

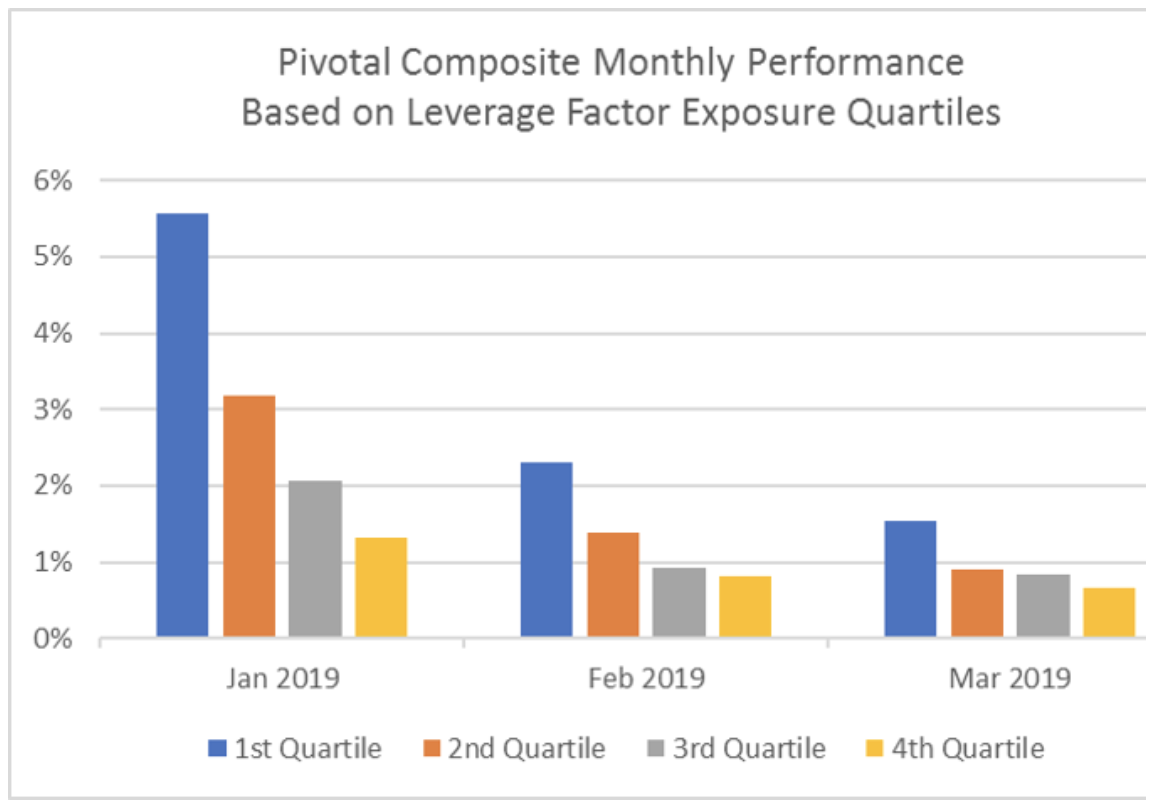

Breaking out performance monthly, we can further observe that the effect was most pronounced in January followed by February, and less notable in March. More than any of the other 150+ factors PivotalPath tracks, exposure to low quality stocks was the most significant determinant of hedge fund performance through the first quarter of 2019.