Most hedge fund investors seek opportunities that offer the potential for attractive returns as well as strong alpha generation. Where should investors look to find a strategy that provides a compelling combination of both?

The PivotalPath Healthcare Equity Hedge Fund Index consistently exhibits this profile, leading the industry in both performance and alpha over short and longer-term investment horizons.

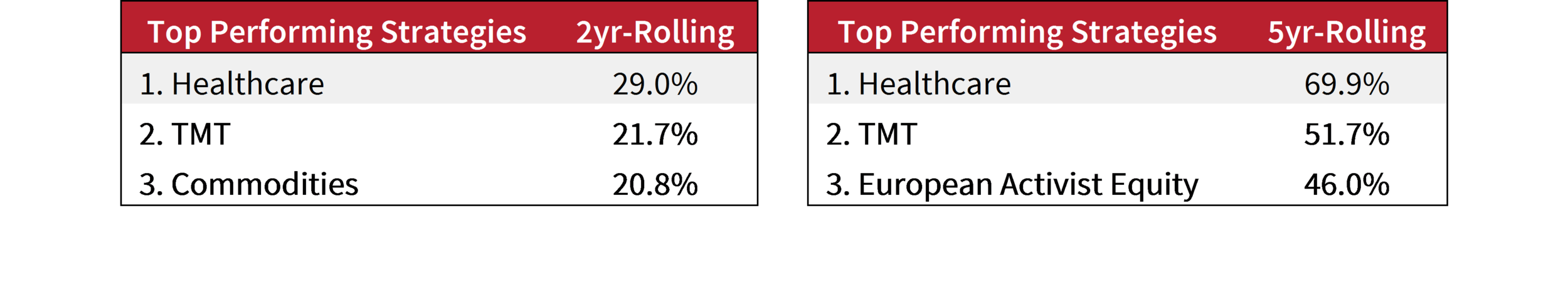

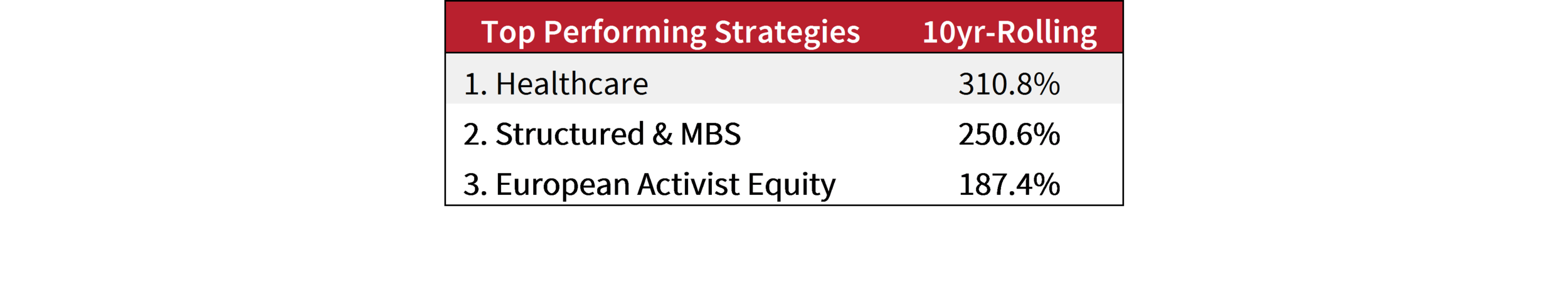

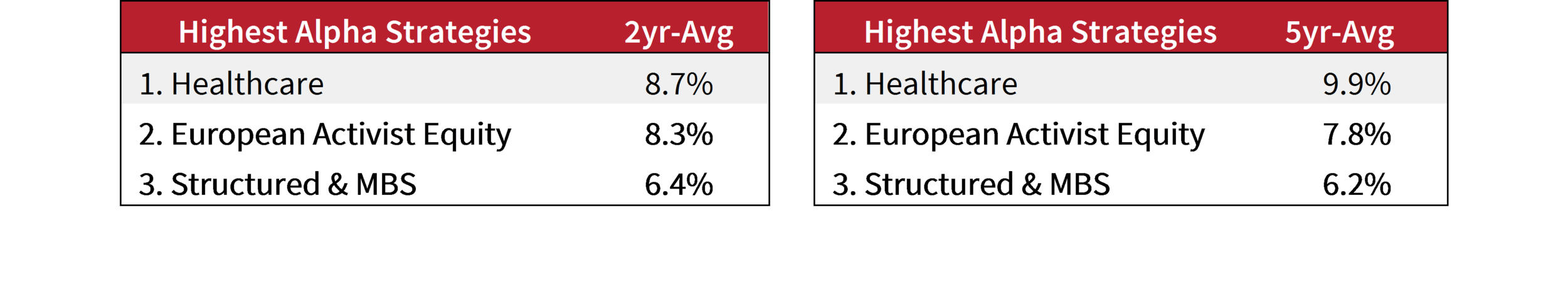

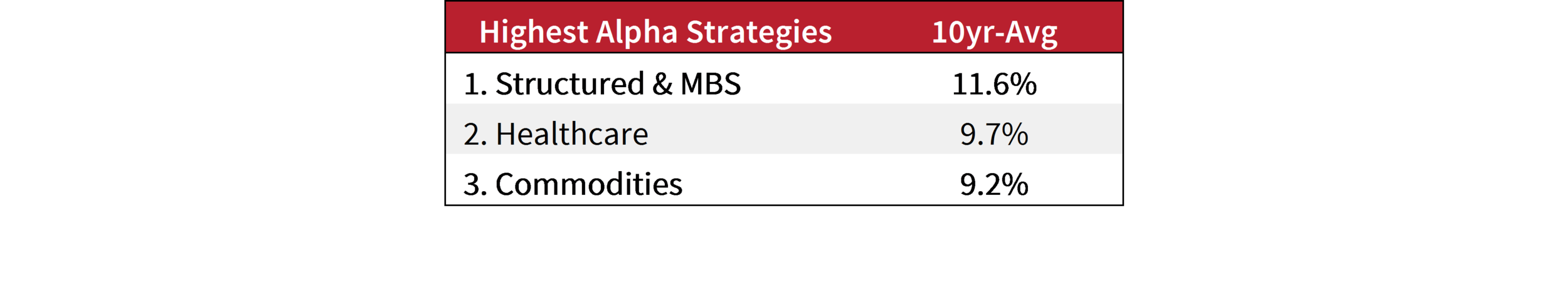

Comparing performance across PivotalPath’s 40+ strategy indices, representing over $2 trillion of hedge fund industry assets, healthcare has been the best-performing sector on a 2-year, 5-year, and 10-year rolling basis (data as of June 2019).

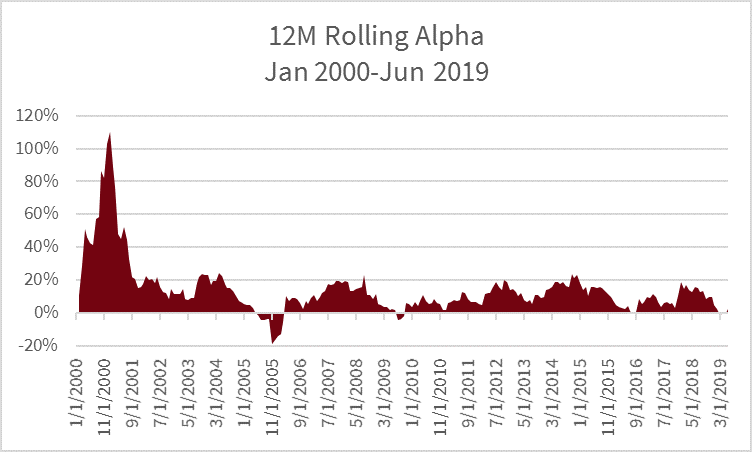

Healthcare has generated the highest alpha of any strategy over the past 2 and 5 year periods, as well as the second highest over the past 10 years. Please note that alpha calculations are based on 12-month rolling alpha relative to PivotalPath’s proprietary risk model – the firm has developed 40+ multi-factor models specific to each hedge fund investment strategy.

In fact, the PivotalPath Healthcare Equity Index has only had two periods of negative alpha, specifically during 2005/2006 and 2009, as seen in the graph below. It is worth noting that both instances of negative alpha coincide with periods of significant economic expansion as defined by the National Bureau of Economic Research, essentially when rising tides have lifted all boats.

As the models show, healthcare offers compelling characteristics for investors who seek consistent alpha and top-of-the-charts returns. Will healthcare continue to serve as a best-of-both-worlds strategy? Stay tuned for Part 2 of this series.