There has been an overall negative tone around the hedge fund industry in recent times – a seeming consensus that hedge fund closures and poor hedge fund performance have become commonplace. From our vantage point at PivotalPath, with a window into over $2T of industry assets, in partnership with over $75B of institutional investor capital, we have observed a different dynamic, one that is far more positive.

Our sanguine viewpoint, as allocators, comes from asking the right questions. In doing so, we realized that much of the recently cited data is misleading due to a limited view of the hedge fund universe.

For example, to fully understand the depiction of hedge fund closures, there are a number of important questions that need to be answered. How many funds are included? Are the funds institutional? What is the average AUM and AUM breakdown of the funds? What strategies do the funds cover? What is the length of track record for the funds included? Most likely, databases that reference a high number of hedge fund closures include funds that should have been excluded from the analysis since they are smaller and less reputable – i.e., most institutional allocators would not consider them for investment.

Additionally, does the dataset include unique funds only or does it count different fund vehicles and share classes as separate funds? For example, a fund might have two vehicles (onshore and offshore) and three share classes for each vehicle (Class A, B, and C); if the fund is shuttered, is this counted as one liquidated fund or as six liquidated funds? In our view, the latter count is highly misleading and inflates the dataset.

We would also bring up the question of success versus failure – should a multi-billion-dollar hedge fund that is shutting down after years of strong performance be considered a fund that is failing? We don’t believe so. Along these lines, there were a number of large, “successful” hedge fund firms that shut down last year, which also inevitably skews this year’s total dollar amount of redemptions/capital returned higher.

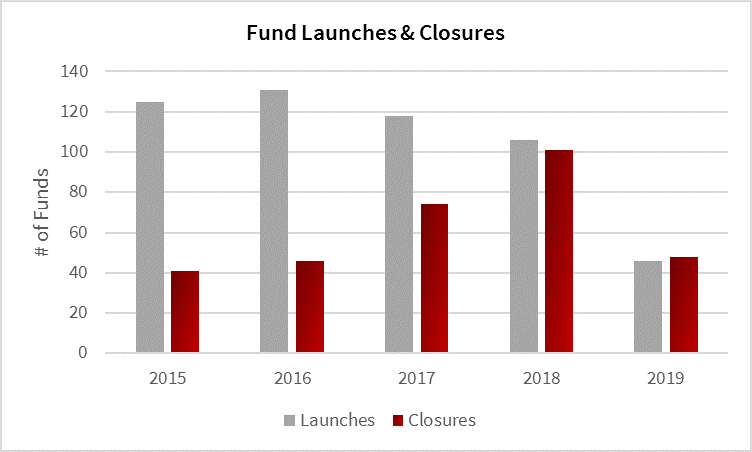

PivotalPath’s universe of approximately 2,000 hedge funds represents what we believe to be a more refined, more appropriate universe for institutional investors. Given our relationships with leading endowments, foundations, wealth managers, pensions and family offices, funds understand we are an integral part of the investment ecosystem, and they trust us with their data accordingly. Using our data, the number of hedge fund closures was much smaller (and we think more relevant to active allocators) than the conventional view. Based on the funds that PivotalPath tracks, there were 48 fund closures in 2019. This compares to 2018, which had twice as many liquidations at 101 fund closures and 2017, which had 74 fund closures. We tracked a total of 310 funds that shut down in the past five years.

While we did see a decline in the number of fund closures in 2019, we have also seen a decline in new fund launches over the years, with a large drop-off in 2019. PivotalPath tracked 46 new fund launches in 2019. This compares to 106 fund launches in 2018, 118 fund launches in 2017 and a total of over 525 new fund launches in the past five years. Nonetheless, we believe 2019 was a healthy launch environment as both managers and allocators were encouraged by strong performance and overall positive market sentiment. Additionally, the funds that launched were of higher quality as the bar for a new launch is much higher today than it was in the past.

According to the latest data, the 48 funds that closed down in 2019 had an average AUM of approximately $580 million and a median AUM of approximately $420 million. The 46 funds that launched in 2019 had an average AUM of approximately $240 million and a median AUM of approximately $80 million.

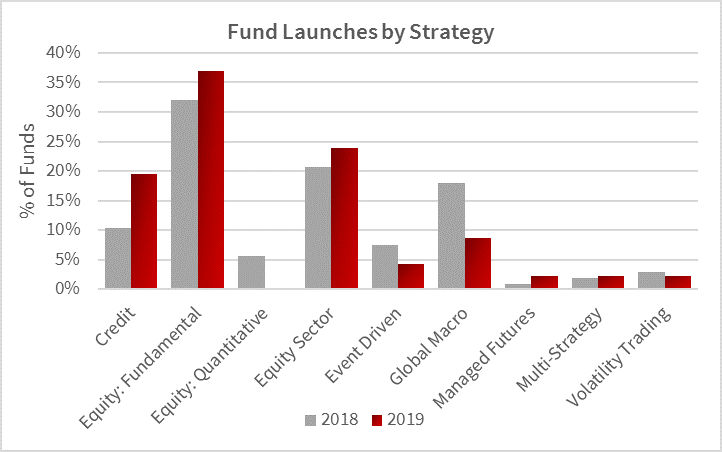

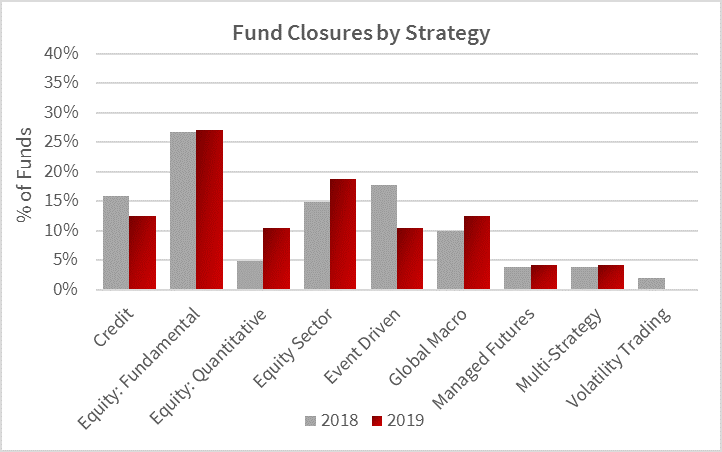

The funds that were shuttered and launched over the past two years fell into various strategy buckets, with the fundamental equity and equity sector strategies as the top two buckets for both closures and launches in 2019 and for launches in 2018.

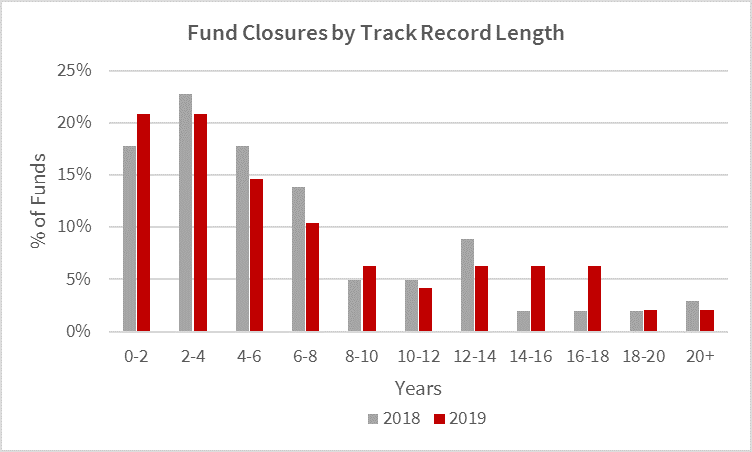

The average length of track record for funds that shuttered in 2019 was just over seven years. The shortest track record was five months, the median track record length was five years and the longest was 26.5 years. In 2018, the average track record length of shuttered funds was about 6.5 years. The shortest track record was four months, the median track record length was five years and the longest was 24 years.

What resonates in the data for both years is that approximately 20% of hedge funds shut down within the first two years after launching and over 50% of hedge funds shut down within six years of launching. It will be interesting to see how this will compare to what we see in 2020. Given 2019 had a smaller, more select set of higher quality launches, we might expect to see a decrease in the number of funds shutting down within the first few years. It also helps that hedge fund performance was strong in 2019, which we look to cover more in-depth in an upcoming piece.

Overall, we believe the hedge fund environment is in a much better state today than it was at the end of 2018/beginning of 2019. And we believe investor appetite for hedge funds is still very much present. In fact, we have heard this firsthand from the institutional investors who comprise our client base: (1) they are actively doing work in the space and (2) they have capital to allocate.

We see a far different picture than what you might have come across based on numerous data reports. To truly understand what’s going on in the hedge fund industry, you need to have structured, comprehensive data and the know-how to navigate it. Fortunately, we have both.