We know that many hedge fund managers had a tough time in Q4 2018 before rallying back in Q1 2019 (see our thoughts on who rallied back the most here). However, when we look back farther, there are a number of hedge funds among the 1,700+ funds PivotalPath covers that generated outsized, positive returns for the month of August, 2018. For many of those managers, their large August returns led to relative outperformance for the entire 2018 calendar year. Notably, all from a month when the S&P 500 returned 3%.

Significant outperformance relative to peers, especially in difficult years, can have lasting influence on future fund evaluation and investment decisions. Accordingly, some of these same managers are still catching investors’ attention today. What might be the secret? Cannabis.

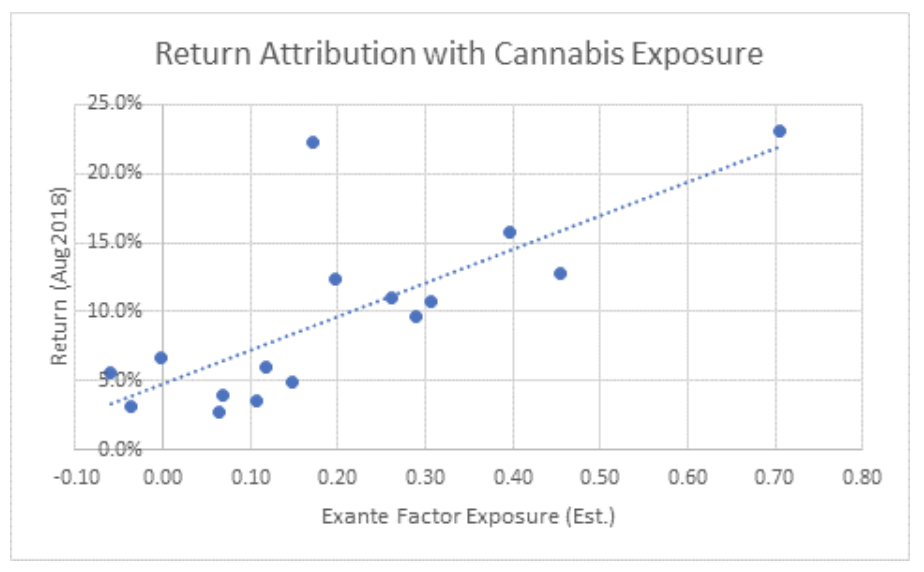

Using our performance attribution tool, we observed that 75% of the August outliers came from PivotalPath’s U.S. Equity Long Short and Sector specific strategies. First, we noticed that none of the exposure to the usual factors (such as the S&P500) was enough to explain even a fraction of their outsized returns for that month, which were averaging over 3 standard deviations from their own recent history. Our tools then systematically searched our database of 200+ risk factors we use to evaluate hedge fund performance. Only one factor aligned with the performance of these outlier funds, both at an individual fund level and in cross-section – the ETFMG Alternative Harvest ETF, better known as the cannabis factor.

While our analysis focused on hedge fund performance, this phenomenon may have extended to active managers in the traditional long-only world. Some managers are more forthcoming than others about how they generate returns, especially surrounding a controversial investment, so it is often up to the investor to ask the right questions.

Managers were generating big returns by buying and selling weed in 2018. What’s driving performance in portfolios today? Find out more by signing up for our Pivotal Insights.