Special Edition: Focus on Inflation

-

Today, potential inflationary effects on portfolios are top of mind for allocators amidst rising commodity prices, labor constraints, supply chain disruptions and additional fiscal stimulus that may come down the pike. Given these concerns, for the first time in nearly a decade, allocators are seeking our counsel for how best to analyze the positioning of their hedge fund exposures given various inflation-related scenarios.

-

For investors anticipating the rate of the 10-year climbing as the market prices in inflation, we offer historical guidelines below. These insights are derived from our recent study of 23 years of market and proprietary hedge fund data and are designed to empower allocators as they weigh asset allocations between hedge funds and equities amid rising rates. Please note all findings reference the 10-year yield as a proxy for rising rates.

-

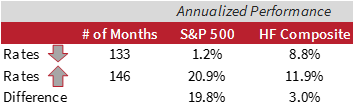

Conventional wisdom suggests that higher rates aren’t favorable for equity market performance. That’s true, once they get there. However, while rates are in the process of moving up, the S&P tends to generate very strong performance, resulting in a high relative bar for hedge funds. During months when the 10-year yield increases, the S&P 500 has annualized at ~21.0% compared to ~12.0% for the PivotalPath Hedge Fund Composite contemporaneously, per 133 monthly data points.

-

Across strategies, Equity Diversified, Equity Sector and Credit funds have been top performers during these periods, while Global Macro and Managed Futures were laggards.

-

However, when rates arrive at their elevated destination (~3.0% for the purpose of this analysis), ALL hedge fund strategies outperform the S&P 500 substantially.

-

More good news for allocators, when rates move back down, ALL hedge fund strategies outperform equities on the way. To wit, the PivotalPath Hedge Fund Composite Index annualized at approximately 9.0% to the S&P 500’s 1.0% return during those same periods, collectively totaling just under 150 monthly data points.

For additional insight into which hedge fund strategies outperform in various interest rate scenarios, contact inquiry@pivotalpath.com