November 2020

For most of U.S. history, presidential elections remove uncertainty from markets – regardless of which candidate or party wins. As we transition to a regime of greater certainty every 4th November, we see managers outperform in the 3 months following an election relative to their performance in the 3 months prior. Even during the contested election of 2000, this trend held.

What happens if an election ushers in an era of even greater, and persistent, uncertainty? We’d be in unprecedented (or should we say ‘un-presidented’) territory.

Throughout PivotalPath’s history, our firm has collected and structured millions of data points relevant to evaluating hedge fund performance. As we examine this data and zero in on election vs. non-election years, leveraging our indices which date back to 1998, when a significant quorum of hedge fund data incepts. We focused on several points of analysis that are most susceptible to electoral dynamics.

PERFORMANCE

What have we seen in the past?

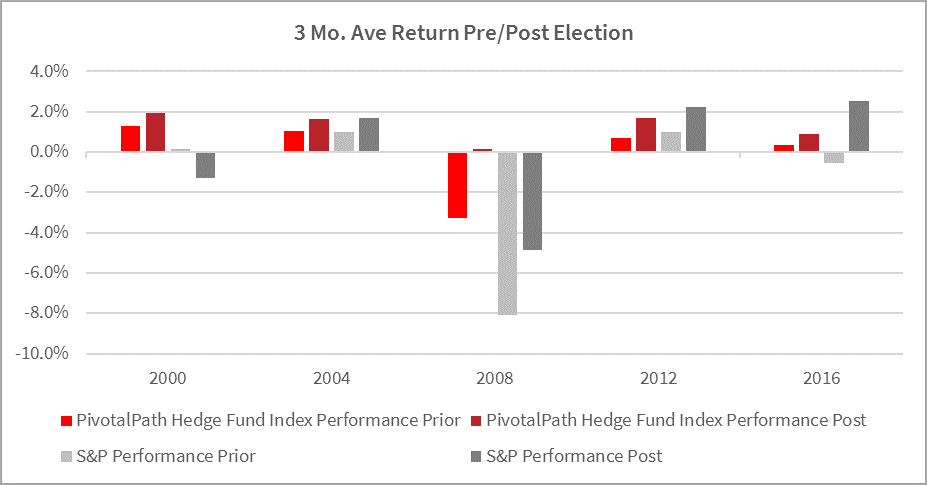

Hedge funds underperform in the 3 months prior to U.S. Presidential elections, whereas post-election, the removal of uncertainty results in outperformance. This has been the case historically, even during the Bush vs. Gore saga of 2000. For the S&P 500, 2000 marked the lone time in 20 years that the index declined following an election, dragged down by election-related, or “hanging chad,” uncertainty. In fact, over the last 5 election cycles, our Hedge Fund Composite has averaged 3 month compounded returns of 3.78% in 3 month periods after an election, vs. an average of 0.14% in the 3 months prior, while the S&P 500 has averaged 3 month compounded returns of 0.25% in 3 month periods after an election, vs. an average of -3.94% in the 3 months prior.

What might we see in the future?

In August and September, hedge funds have returned 0.8% for the 2 months of August and September, while up 2.0% YTD. Will the 3 months post-election bring outperformance over August-October? Over YTD? Or will performance collapse after the 2020 election, for the first time in hedge fund history?

DISPERSION

What have we seen in the past?

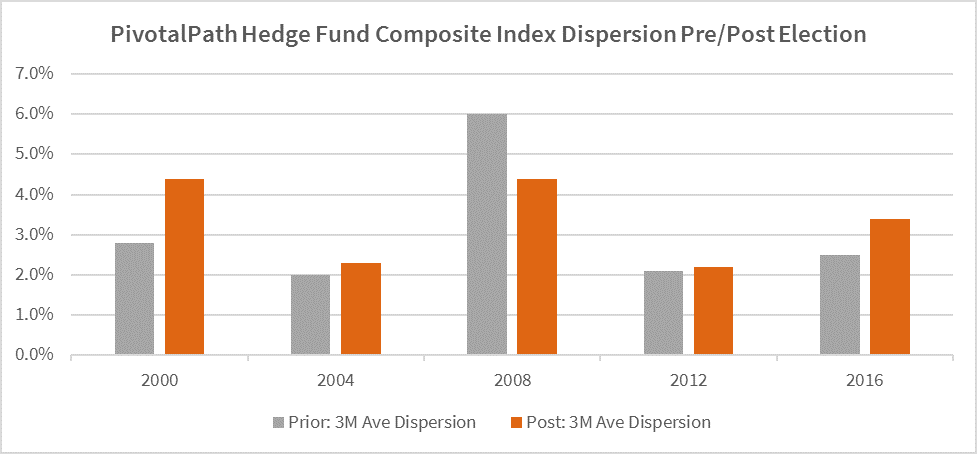

Dispersion has tended to rise slightly following elections, with the exception of 2008 when the world was in the grips of the Global Financial Crisis.

What might we see in the future?

If we follow this pattern, we can expect to see slightly higher dispersion in the 3 months following the election. Or will we set another record in 2020? In March, PivotalPath’s Dispersion Indicator set a record high of 11.5% vs. the long-term monthly average of 2.9%.

Will this year bring new record-setting highs? Or, conversely, will dispersion collapse, with all funds in all strategies moving in lockstep?

Alpha

What have we seen in the past?

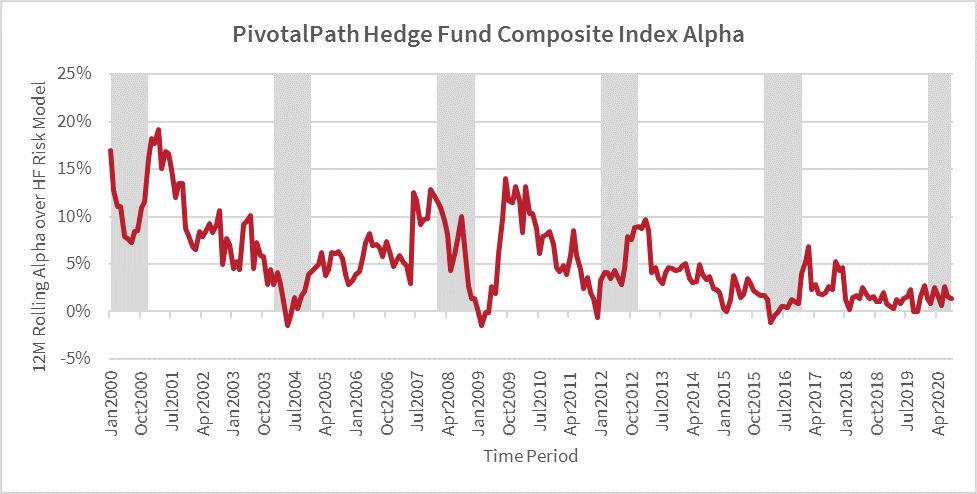

One thing we can see from the chart below, highlighting 12 month rolling alpha of the PivotalPath Hedge Fund Composite Index before and after an election, is that there is little relationship between election years and alpha.

Admittedly, we were surprised. We’d hypothesized that alpha might be higher prior to elections given increased market volatility, which translates to increased opportunities for managers to make money on both the long and short side. While, by design, 12-month rolling calculations exhibit significant overlap when focusing on 3-month periods before or after an election, the data still suggests that little historic relationship exists.

What might we see in the future?

Alpha has not tended to trend up or down before or after presidential elections. Will 2020 mark the first time we see a clear, and dramatic, directional move as the result of the election outcome? Will funds generate more alpha, protecting investors from market swings? Or will alpha evaporate in an environment where fundamentals deteriorate universally?

THE LONG AND SHORT OF IT

Simplistically, the word election means “chosen out of” – in 2020, very little seems chosen, making it harder than ever to plan for a post-election reality.

However, we can choose what data we use to inform our decisions in the coming months. What historical hedge fund patterns (certainty), or lack of (uncertainty), will affect portfolio, strategy, and manger allocations post-election? Will we, as allocators, approach November 4th and beyond through different eyes when it comes to performance, dispersion and alpha? Is history our roadmap? Or will we face uncharted territory?

Knowing the data points that matter is the best preparation we can get.