Updated March 24, 2020

2020 has been a rollercoaster for markets across stocks, bonds, currencies, and commodities. One of the strategies that has been hit the worst so far (out of 40 sub-strategies that PivotalPath tracks) is risk premia. The PivotalPath Risk Premia Index was down 4.4% in February (down 4.2% YTD), compared to the PivotalPath Composite Index (including all hedge fund strategies), which was down only 1.3% (down 1.0% YTD).

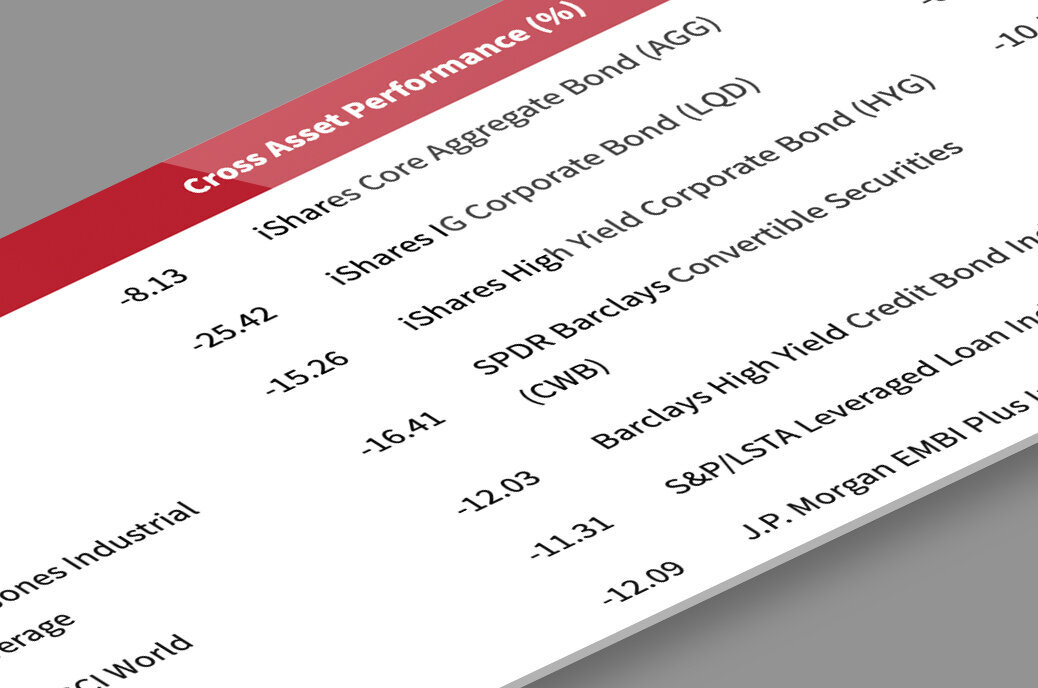

To give some insight into how the strategy is performing through March, we ran a regression using PivotalPath’s proprietary risk model for the Risk Premia peer group (assuming exposures of the peer group have held through this month), and estimate that the peer group is down 27.2% month-to-date through March 24th, plus or minus 8.0% (said another way, we estimate that the peer group is down somewhere between 19.2% and 35.2%.) The S&P 500 is on the lower end of that range, down 17.0% month-to-date. For context, by using January betas of the five risk factors in our model, our February estimate for the peer group is 4.4%, which was the actual return for February.

Note that it may be harder to predict returns for March, however, given the heightened volatility in the markets. Many funds may have reduced or changed their exposures since the end of February and, in particular, funds may have been forced to lever down their fixed income exposure during the month. This may, in turn, have contributed to rises in yields through March.

So what happened during February? As investors are likely aware, the markets quickly changed from risk-on to risk-off as the virus began spreading and becoming a significant global threat. Shortly after hitting all-time highs, the S&P 500 reversed course and fell 8.2% over the course of the month. Another significant move was in U.S. Treasuries, as yields came down to historic lows in the first two months of 2020.

Looking at exposures of the risk premia peer group, the peer group as a whole exhibited high correlations and betas to global markets, which, as mentioned, fell significantly in February. Risk premia funds typically have a large allocation to equities, and most are inherently short volatility. This was reflected in our data as the highest negatively correlated factor of the peer group (of the 200 factors/indices PivotalPath tracks) in January and February was the CBOE Volatility Index (VIX). During February, the VIX had its largest weekly percentage move ever (+135%) and one of its largest monthly gains, up 113% for the month.

Risk premia managers also exhibited a short bias to treasuries, as the peer group had negative beta to 2-year, 10-year, and 30-year U.S. Treasury Futures. This negative exposure even increased from January to February. In fact, the largest negative beta of risk premia managers as of February was to U.S. Treasury 2-year Futures, at a beta of -2.33.

If risk premia’s underperformance is continuing into March as predicted, we would expect significant redemptions for the strategy, likely causing further losses. Furthermore, many funds in the space are fairly large (in terms of both AUM and leverage) and liquid and have lenient redemption terms (e.g., daily, weekly, or monthly redemptions). For investors with allocations in the space, funds’ exposures, performance and AUM are key metrics to monitor for March and going forward in 2020.