Not all gains in the S&P are created equally – why hedge funds are targeting underperforming stocks

May 13, 2020

There’s an interesting phenomenon happening right now in the markets – economic reports signal the most devastating news since the Great Depression, yet the S&P 500 has increased 30% since it’s March 23rd lows. As reports get worse, the market holds steady. Many folks wonder what’s missing and if investors are too bullish on an economic reopening. Others maintain that the market is forward-looking and that the current economic damage was priced in months ago.

In short, both of these approaches are far too simple. To really understand what’s going on, PivotalPath tapped into our database of more than 2,000 institutionally relevant hedge funds and created the PivotalPath Social Distance Winners and Losers Baskets. These two baskets incorporate the companies that are most likely to benefit from large swaths of the workforce staying home, as well as the companies who are most likely to be hurt. Here is what is included in each:

-

The “PivotalPath Social Distance Winners Basket” includes stocks in the software, communications, e-commerce, videogame and internet entertainment industries; specifically including names like Zoom, Slack, Netflix and Zynga.

-

The “PivotalPath Social Distance Losers Basket” includes stocks in the airline, cruise line, restaurant, casino and hotel industries, such as Delta, Carnival, Darden and Cinemark.

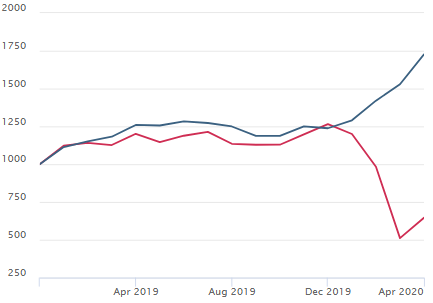

During normal economic times (and by normal, we mean prior to the COVID-19 pandemic), companies in these two baskets tracked relatively closely (correlation: +0.8). Beginning in Q1 2020, however, when the U.S. economy came to a standstill, these two sectors started to diverge. Through April 2020, the Winners Basket is up 39.5% while the Losers Basket is down 49.0%.

This reality is most stark in the figure below – clearly, the dispersion in performance makes the case for long/short investing.

VAMI Chart

Winners Basket (blue) vs. Losers Basket (red )

January 2019 to April 2020

Source: PivotalBase

This chart provides perhaps the clearest picture of how the recent stock market rally is not blindly benefiting all companies. In other words, investors are not necessarily expecting a uniform recovery, and are clearly prioritizing the companies who are benefiting most from the current circumstances.

But that’s only part of the story. If we know the winners and the losers, we expect investors to go long the Winners and short the Losers. However, when we take our analysis a step further, we see something striking – hedge funds have been broadly selling the Winners while maintaining long exposure to the Losers.

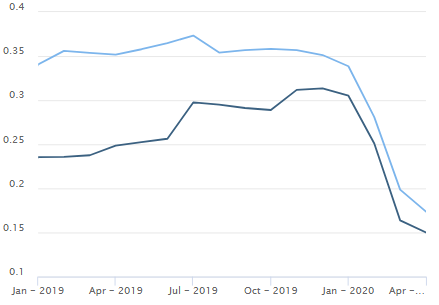

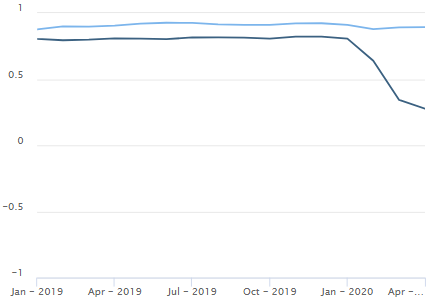

Take the PivotalPath U.S. Equity Long/Short Hedge Fund Index, down 7.2% this year through April. Using that index as a proxy for fundamental equity long/short returns, we looked at its 18-month rolling beta and 18-month rolling correlation to the two baskets.

U.S. Equity Long/Short Funds to the Winners Basket (dark blue) and Losers Basket (light blue)

18M Rolling Beta

18M Rolling Correlation

Source: PivotalBase

How can this be explained? There are two very important realizations for these baskets, which reflect how hedge funds are eyeing the next stage of the pandemic – recovery.

Hedge funds have been taking profits in the winners by selling longs/adding shorts, as exposure has fallen from peak. They view the recent rally in the “stay at home” theme as temporary and think there will be a reversion to the mean as the economy re-opens. In particular, generalist managers appear to be skeptical of the valuations of these crowded names – especially since some of them, like Zoom and Slack, are not generating high revenue for their services, many of which are free, and there is a lot of competition.

Conversely, managers have been holding onto the losers – most of which have already plummeted in value by 50% or more. The correlation of equity long/short funds to the losers basket remains very high but the beta has dropped with the market value losses (from 0.30 to 0.15), which suggests that the holders have not been selling. Instead, hedge funds have remained bullishly positioned in the “beta” names that they believe will be the first to benefit from a re-opening. Managers seem to be banking on a reversal, as people return to their normal lives and once again go outside. They got caught up in those names in the first quarter, but now think the worst is over for those stocks.

This positioning is likely to determine individual hedge fund returns over the coming months. It will be interesting to see which funds come out on top, depending on what happens to social distancing, and stock prices, from here.