December 2020

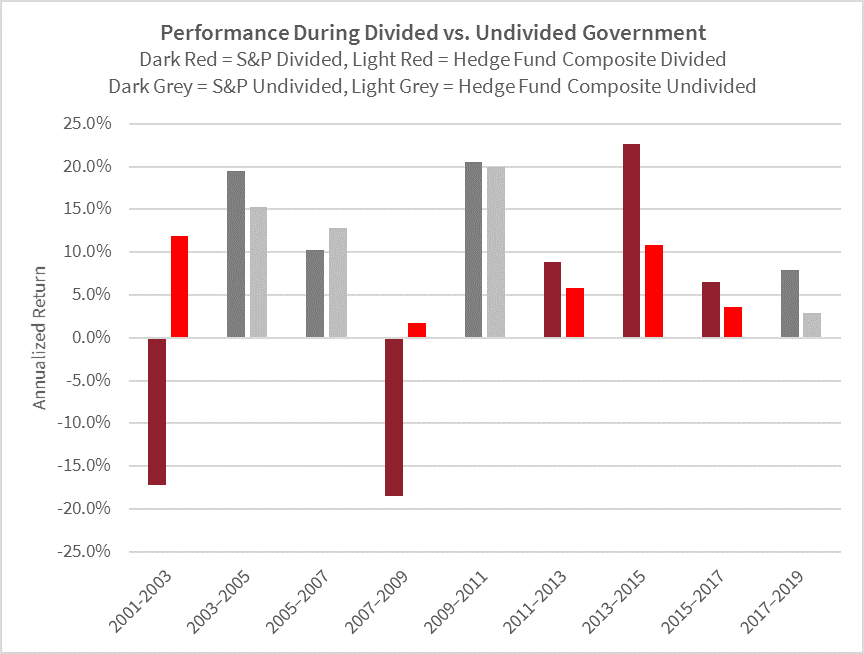

Following the 2020 election, as the Senate majority remains in question, there has been discussion about whether a divided or unified government benefits the markets. The Wall Street Journal recently looked into whether markets historically tended to outperform in either scenario. The answer? Unclear.

At PivotalPath, we constantly leverage our data, covering over $2.3T of hedge fund industry assets, to gain insight into the intersection of global events and the hedge fund industry. While there may not be a clear relationship or pattern for broad markets during eras of divided government, maybe we can find more pronounced differences through the lens of hedge fund performance. And, in turn apply those findings in conversations with our clients, who allocate over $100B to hedge funds. Here’s what we found:

As you can see, there wasn’t as dramatic a difference in performance as we’d hypothesized. Instead, we did find that the S&P and the PivotalPath Hedge Fund Composite Index tended to move more closely during periods of undivided government rather than divided.

As always, we ask questions and identify factors that could determine potential implications for our industry’s trajectory over the next congressional term. Most importantly, we ask questions to advise our clients in making better allocation choices for their portfolios.

Please stay tuned for our year-end analyses on 2020 performance and the effects of COVID-19 on hedge fund launches and closures this year