As we’d written about in August 2019, correlations between all hedge fund strategies and 200 global risk factors had been moving in lockstep. In fact, these correlations had risen to levels only seen two other times in the last 20 years – once leading up to the Global Financial Crisis and once again in 2012. This past September and October however, those correlations began coming off their highs.

The chart below depicts these correlations among strategies over the past 20+ years.

What might this nascent shift in global correlation levels mean for investors as we head into 2020?

As pairwise correlations decrease and dispersion creeps into the markets, allocators will start to see the effects in portfolio performance. More specifically, it will create a favorable environment for hedge funds investors.

KKR recently published a research piece titled Wisdom in Curiosity that supports this position. Citing KKR’s implied default indicator for US High Yield, rising geopolitical tensions and slowing liquidity growth, the firm suggests that we are entering a multi-year period of rising dispersion in asset class performance and market dislocations. As seen in the chart below, KKR predicts this environment will be far more supportive of overall hedge fund returns than the previous five years have been.

What does all of this mean for investors?

Dispersion generally favors hedge funds, creating buying opportunities on both the long and short sides. Of course, it also leads to significant dispersion in manager performance.

As a starting point for manager selection, PivotalPath employs a systematic manager ranking system, tracking funds vis-à-vis their strategy peers on alpha generation, drawdown management and relative performance. We then combine these three inputs into one overall score, known as the PivotalRating. This metric has been successful (out of sample) in broadly predicting managers that outperform and underperform their peers in the following year on an absolute and risk-adjusted basis.

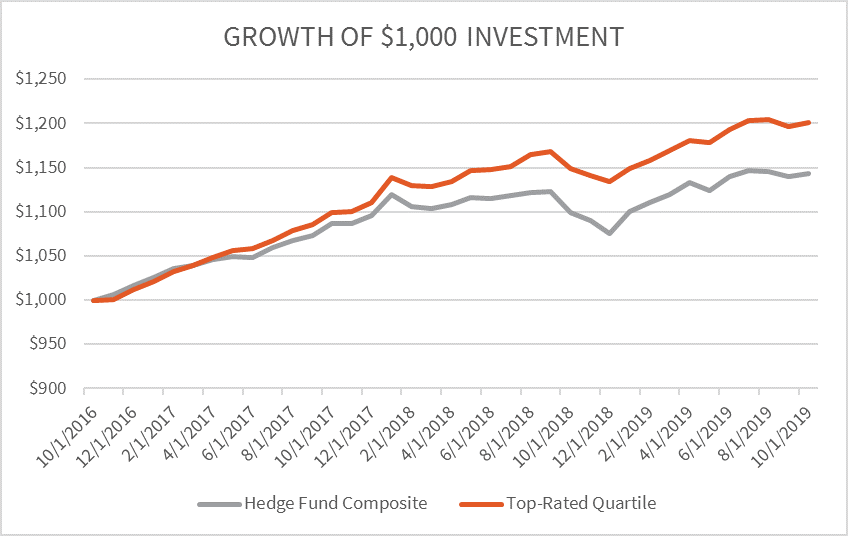

Put simply, imagine allocating to two hedge fund portfolios at the end of 2016. In one, capital is allocated for the next three years, equally, across all funds that comprise the PivotalPath Hedge Fund Composite Index – the most comprehensive index on the market, representing over $2 trillion of hedge fund industry assets . In the other, only managers in the top quartile of PivotalRatings receive capital for the following three years. As of today, without any consideration for strategy selection, pedigree, sizing etc., and without intra-year modifications, the ratings-driven portfolio would have outperformed the broader index by over 5%.

This 5% difference in return over the past three years coincided with the period of rising global correlations discussed above. As we enter a period of falling correlations and rising dispersion, a realized difference in systematic return is likely to be far more overstated.

When thinking about what this might mean for the future, here is the important takeaway – falling correlations and high dispersion means that manager selection is incredibly important. It translates to substantial differences in performance. Predictive indicators provide a useful starting point to identify which managers to avoid, and which ones to focus on.