Solutions

PivotalPath tracks and analyses

-

2,800+ Institutional-Quality Hedge Fund Peers

-

$3T+ Global Fund Assets

-

46+ Hedge Fund Indices

Solutions

Comprehensive data, robust analytics, and truly representative benchmarks – PivotalPath’s research offering includes a suite of apps to facilitate individual manager research which include industry and custom benchmarking tools, a dedicated Index platform and customized research solutions.

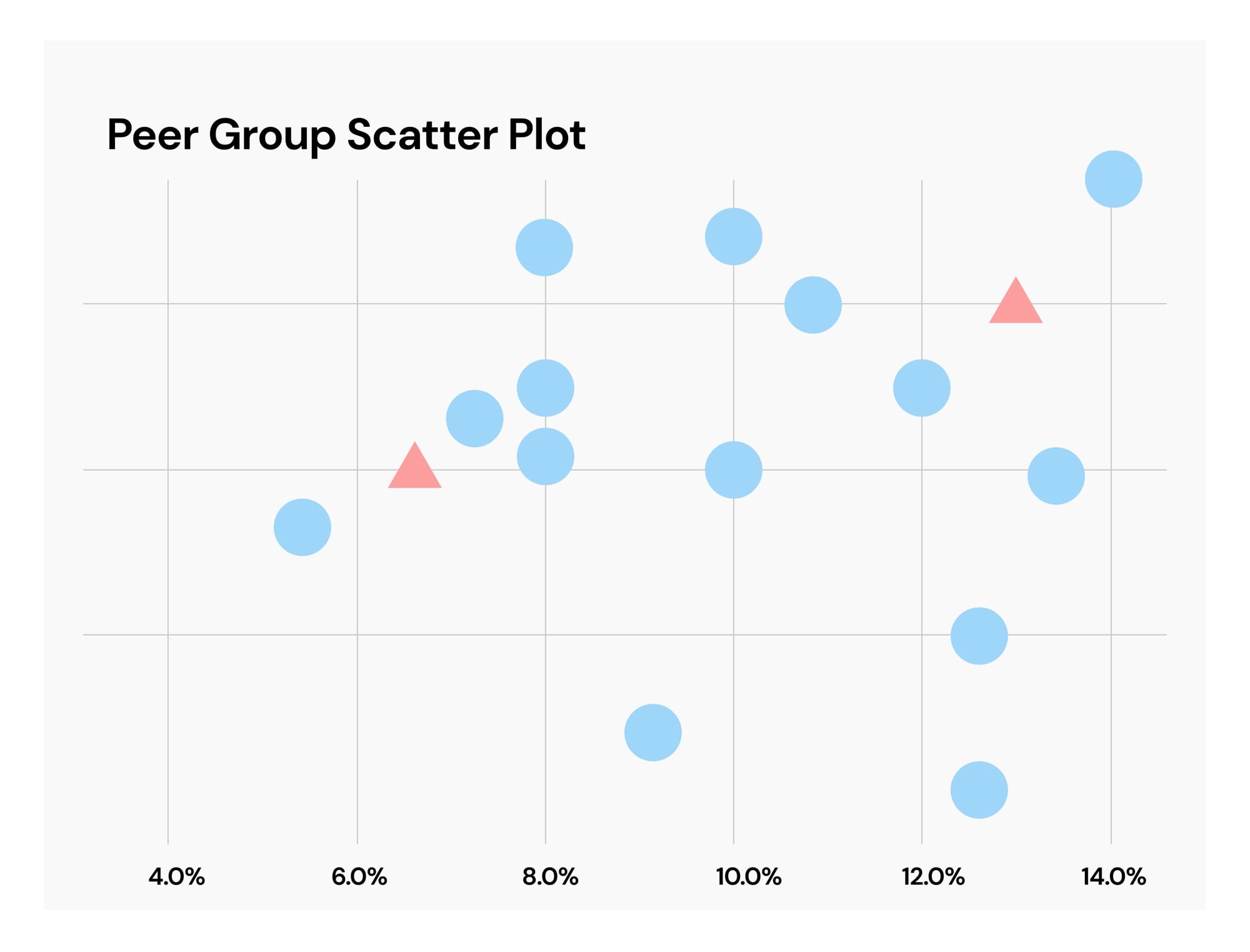

By providing qualitative and quantitative information on individual managers, tools to analyze fund performance, and accurate industry benchmarks, we help our clients answer their most complex questions and empower the full cycle of hedge fund investment due diligence.

Products

Our combined decades of expertise and solution-driven methodology shape our portfolio of industry-leading products. PivotalPath’s research portal caters to institutional investors by offering:

-

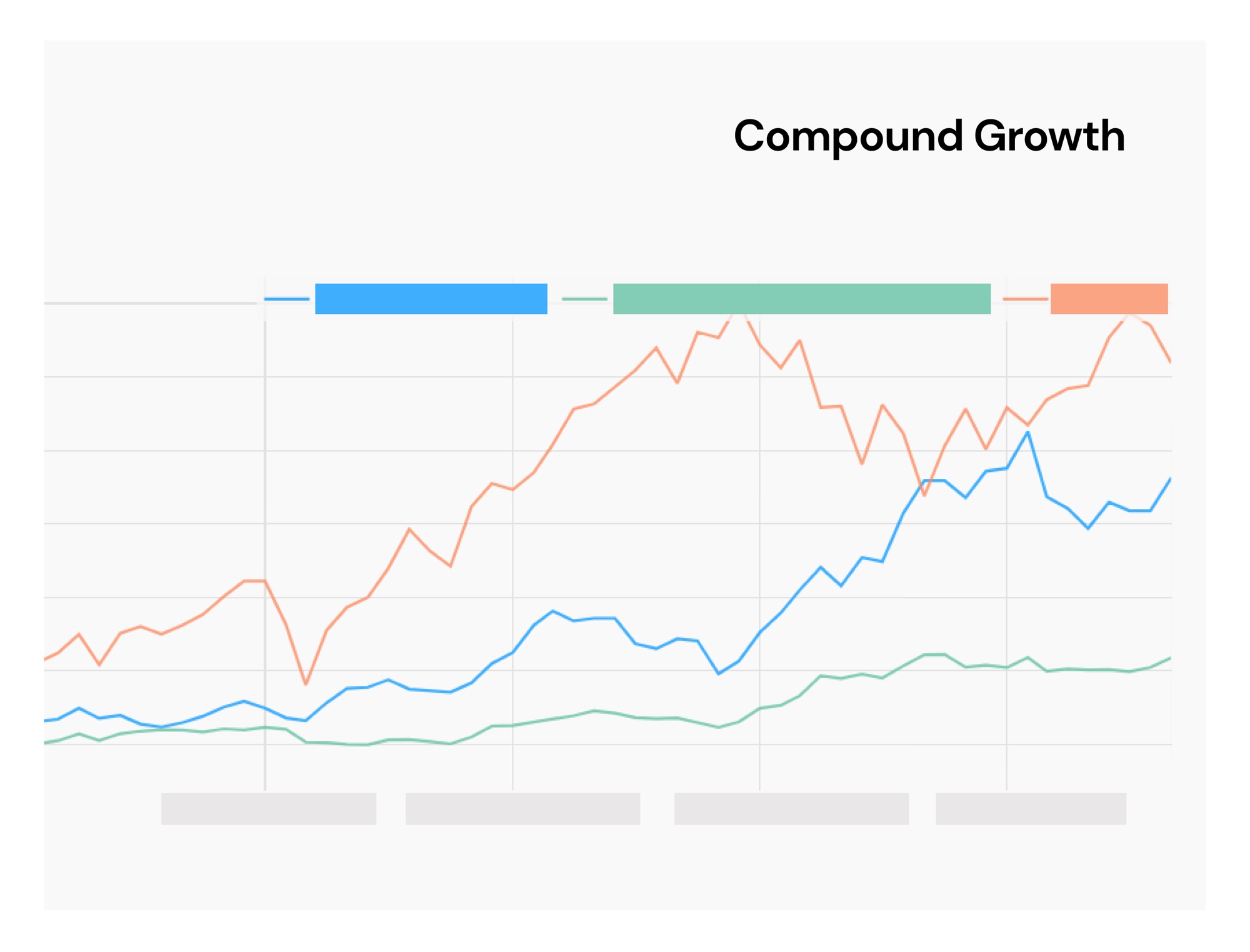

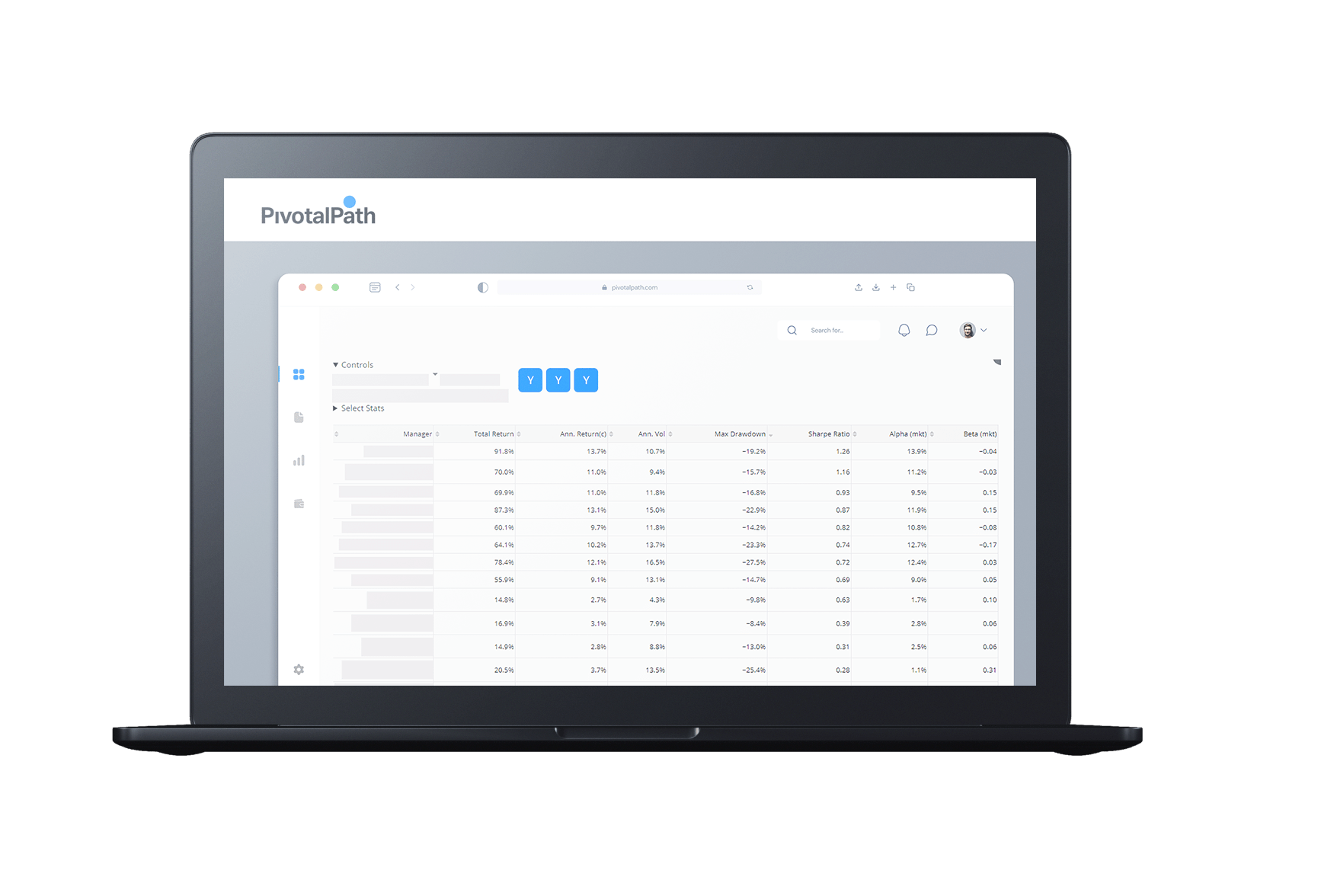

A hedge fund research platform delivering meticulous fund performance data and in-depth qualitative information.

-

An analytics platform for precise industry benchmarking and customizable benchmarking options.

-

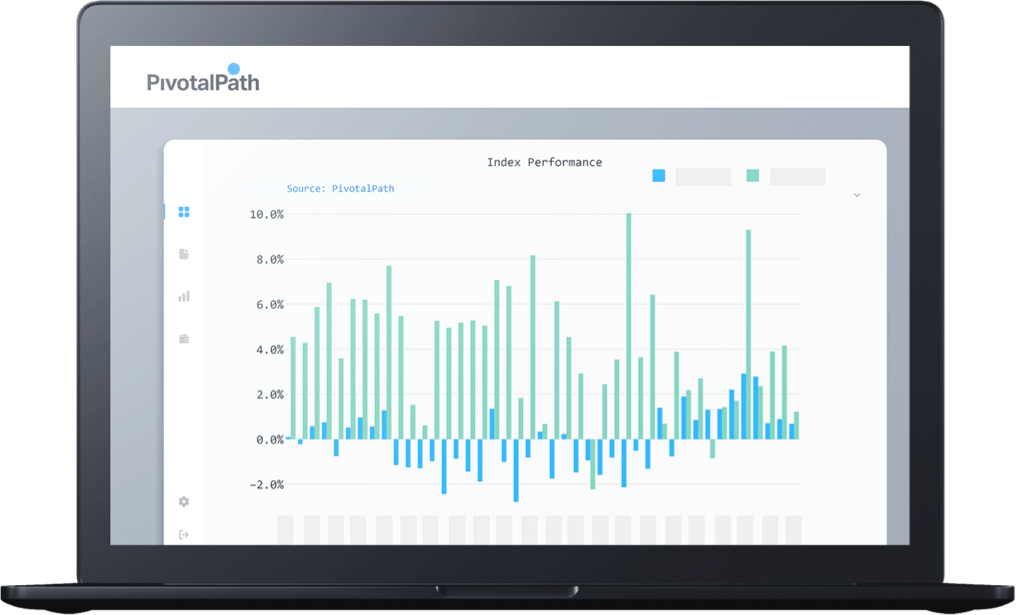

A hedge fund index platform facilitating sector index analysis.

-

Comprehensive data, significant domain knowledge, and flexible infrastructure enable us to continuously meet our clients’ unique information and analytic needs.